The history of thought is an inherently tricky evidentiary exercise, as it typically involves a need to discern intention from written words left by the subjects in question. Its better practitioners attempt to understand the parameters of a particular decision or argument by weighing the available evidence around it and interpreting it in light of the context in which it was made. Typically implicit is a willingness to follow that evidence where it leads, even when the implication is unexpected or, in cases involving thinkers of prominence, an unwelcome mark on their reputation.

This contrasts with a more problematic approach wherein the historian begins his or her investigation with an explicit case to “prove” and thus begins the evidentiary process by casting about for bits and pieces of material to support the predisposed thesis. Or in the case of written matter, begins with a search for narrow and esoteric renderings of the subject’s work, so as to extract from it a contingent and favorable rendering toward the predisposed position. As no investigator is ever truly impartial, the tendency to slip into this latter approach is a persistent danger, though one that may also be mitigated with an empiricist’s grounding. But when the historical enterprise itself begins with an act of simply casting about for bullet points to get around a past figure’s shortcomings, the whole enterprise quickly devolves into counter-historical territory – into exercises in exonerative history that attempt to parse a past figure away from something embarrassing, or something that simply “went wrong” in ways that defied his intentions or expectations.

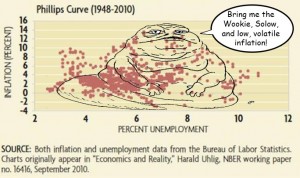

Such seems to be the case with a relatively new and unusual approach to the contributions of economist Paul A. Samuelson as they pertain to the Phillips Curve. Samuelson’s work on this subject in the 1960s has long been linked to an embarrassing episode in prescriptive Keynesian policy-making wherein an exploitable inverse relationship was posited between unemployment and the price level. Drawing upon a famous 1960 article in the American Economic Review by Samuelson and Robert Solow in which its authors investigated and adapted a perceived empirical relationship between employment and wage levels in the work of A.W. Phillips, policy-makers in that decade and for some time beyond consciously used the Phillips Curve as a structural relationship on the basis of which to conduct macroeconomic policy in the United States. As one of the article’s more notorious passages suggests,

“In order to achieve the nonperfectionist’s goal of high enough output to give us no more than 3 percent unemployment, the price index might have to rise by as much as 4 to 5 percent per year. That much price rise would seem to be the necessary cost of high employment and production in the years immediately ahead.”

In its most problematic iteration, the Samuelson-Solow derived Phillips Curve fostered a belief that monetary inflation could function as an acceptable trade-off, along side which low unemployment could be obtained in the United States. While this did not necessarily commend an intentional inflationary policy to combat unemployment, it did foster an increased tolerance for inflationary circumstances on account of the presumed tradeoff…that is, until the whole thing came crashing down with the stagflation episode – simultaneous high inflation and unemployment – in the 1970s.

Followers of the economic literature of the time will also probably be aware that the attempted operationalization of the Phillips Curve in the early 1960s underwent a series of damning critiques in the theoretical literature as well by Milton Friedman, Edmund Phelps, and Robert Lucas in particular, the gist of which (1) left the Curve practically impotent as a basis for prescriptive policy, as had been theorized and attempted in the wake of Samuelson-Solow, and (2) highlighted the dangers of the very same in showing it to be the genesis of prolonged stagflation. While a number of modified “Phillips Curve” relationships – usually tied to short run phenomena – have persisted in the macro world ever since, they bear little resemblance to the original Samuelson-Solow articulation of the concept and offer little in the way of policy advice, which had been a central feature of the Samuelsonian version.

All said, the Phillips Curve episode proved quite embarrassing for the type of prescriptive macroeconomics that first brought it to prominence and remains a warning against the perils posed by a macroeconomic outlook that approaches policy as a matter of simple lever-pulling to manipulate overall output patterns in a seemingly desired direction.

The Revisionist Case Considered:

While the Phillips Curve experience of the 1960s is well known (and indeed the basis for multiple subsequent Nobel Prize citations), a recent attempt has been made at the rehabilitation of Samuelson’s reputation as a prime instigator of the episode. The gist of its argument is that Samuelson and Solow never really intended the Phillips Curve to be a “stable and exploitable” relationship, and that the subsequent attribution of this charge to them starting with Friedman (1968) onward is a “myth.” In some iterations, the Samuelson-Solow (1960) is either assumed to have been misinterpreted by the field and/or public as offering a prescriptive policy relationship, or its subsequent influence to that effect is also deemed a further part of the “myth.”

The most detailed examples of the revisionist case are laid out in this 2010 article by James Forder, critiquing Friedman’s self-accounting of the deficiencies in the Phillips Curve, and a followup working paper on Samuelson himself, which has gained a fair amount of subsequent currency in some quarters of the economics blogosphere. Forder’s argument also finds currency, to some extent, in another recent working paper by Kevin Hoover and appears to be the basis of a forthcoming book, due out this October.

As the two Forder papers are the most developed examples of the revisionist literature, I’ll focus primarily on their contributions. Both pieces are worth reading as both a history of how the economics profession grappled with the Phillips Curve, and for consideration of the arguments made therein. Briefly summarized, Forder mounts an extended challenge to whether Samuelson and Solow actually intended for the Phillips Curve to be interpreted as an exploitable trade-off for policymaking. He approaches this issue on many fronts, both internal to the Samuelson-Solow (1960) paper and its developing external reception and reputation ever since.

In doing so, Forder relies heavily upon finding textual qualifiers, nuance, and a number of hedged predictions – typical of academic writing – to effectively leave its authors an “out” to their oft-noted association with the policy errors of the 60s and 70s. Some instances are more successful than others, including his drawing attention to Samuelson & Solow’s postulating that the theorized curve for the U.S. had “shifted somewhat” in prior decades. This, he supposes, is an answer of sorts to the presumed stability of the curve that would make it an exploitable relationship, at least in the critique offered of it by Friedman.

It might be noted in response that Samuelson and Solow’s apparent cognizance of the Phillips Curve’s “shiftiness” actually appears to have extended its manipulable characteristics in their minds, thus its closing paragraph suggests not only a belief in the exploitable nature of movements along the curve but also the possibility of further controlling the external parameters of those movements by shifting the curve itself in a more conducive direction. To frame the reception of Samuelson and Solow as a dispute over “stability,” in the sense that it portended a permanently fixed and non-shifting relationship, might thus be a simple confusion of terms. Samuelson and Solow seem to have believed they were dealing with a relationship that they could (1) internally base policy upon where the Phillips Curve presently stood – an implied stability of sorts when operating along that curve, but hardly an immovable one – and (2) if needed, externally manipulate the curve to a better plane through certain external prescriptive measures. Any “shiftiness” was something they believed – quite literally – that they could control and even induce with the “right” types of policies:

“These could of course involve such wide-ranging issues as direct price and wage controls, antiunion and antitrust legislation, and a host of other measures hopefully designed to move the American Phillips curves downward and to the left.”

So yes, in a very narrow sense Forder is correct that Samuelson-Solow (1960) recognized a shifting Phillips Curve. It is not at all apparent though that they saw this as a destabilizing feature of the relationship. To the contrary as the line above indicates, they interpreted the Phillips Curve’s “shiftiness” as another another lever to manipulate through a suite of complimentary policies. And they did so from the very outset of their work.

As a brief aside I cannot stress the importance of that final paragraph in Samuelson-Solow (1960) enough. We will return to it shortly, as it set up precisely where Samuelson was going with his Phillips Curve analysis: a model that could be exploited via movement along the curve itself and by externally inducing a favorable shift in the curve to create a more idealized set of conditions for the aforementioned movements.

But what of Samuelson and Solow’s policy objectives in the 1960 article? They do indeed pose additional problems for Forder and the revisionist account. One of the better known instances comes from Solow himself, who in later years strongly suggested that he and Samuelson saw the Phillips Curve as an exploitable tool for macroeconomic policy purposes at the very outset of their inquiry. In an interview given to the MIT alumni magazine in 1978, Solow recounted a conversation in the late 1950s after his reading of the original Phillips paper:

“I remember that Paul Samuelson asked me when we were looking at those diagrams for the first time, ‘Does that look like a reversible relation to you?’ What he meant was ‘Do you really think the economy can move back and forth along a curve like that?’ And I answered ‘Yeah, I’m inclined to believe it’ and Paul said ‘Me too.’ And thereby hangs a tale.”

Forder’s handling of this reminiscence is unconvincing. He attempts to work around it by narrowing the contextual applications of the quote to an endorsement of an inflationary prescription out of the trade-off. Yet the issue of Samuelson-Solow (1960) was always the existence and use of an exploitable trade-off itself, not necessarily its consequential disposition toward inflationary policies which is a product of its political economy. But needless to say, there is much in both the article and Solow’s recounting of its genesis to suggest that its authors had a direct interest in applying it to prescriptive policymaking.

Samuelson as a Prescriptive Phillips Curve Economist:

In fact, the evidence is overwhelming that Samuelson actively pressed policymakers to employ his Phillips Curve trade-off prescriptively in the immediate wake of the 1960 article. It is this political context that is largely missing from the textual analysis of the revisionist account, and it tends to show that an accompanying depiction of the dissemination of Samuelson-Solow (1960) in the academic literature is very incomplete – and perhaps even partial to presenting an exonerative interpretation.

Even Samuelson-Solow (1960) was an academic revamping of an earlier and more prescriptive paper they drafted in 1959 and presented at the American Economic Association in the context of its policy implications. To this end, Samuelson and Solow went on to publish an extended passage from the 1959 original as a chapter in Arthur M. Okun’s 1965 book The Battle Against Unemployment. Its title reveals a directly prescriptive intent, “Our menu of policy choices,” and the excerpted passages center around the prescriptive characterization quoted above wherein a price level rise is described as a “necessary cost of high employment and production.”

But of perhaps more direct significance to the 1960 academic article’s influence, Samuelson himself actively went to work in pressing it upon congressional legislators and suggesting it could be used as a basis for crafting unemployment policy!

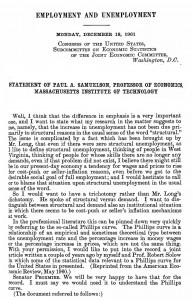

An early occasion came in December 1961 when Sen. William Proxmire (D-WI) invited Samuelson to address a hearing of the Joint Economic Committee on the problem of unemployment. Note that at this time the Phillips Curve’s implied connection between employment and the price level was still a very new concept. The hearing thus had no particular charge to investigate inflation or any related aspect of monetary policy. That is until Samuelson introduced it by way of the Phillips Curve, which he presented to the committee as something of a cutting edge concept to emerge from the economics discipline. A relevant passage from the hearing transcript may be seen below in which Samuelson introduces the Phillips Curve to the committee and suggests that it operates as both a constraining and prescriptive mechanism for them to consider. The relationship, he suggested, implied the existence of “a tendency for wages and prices to rise for cost-push or seller-inflation reasons, even before we got to the desirable social goal of full employment.”

This tendency, Samuelson continued, was “an institutional situation in which there seems to be cost-push or seller’s mechanisms at work,” that institution being the referenced Phillips Curve. The implication of the curve as he then explained was “a relationship of an empirical and sometimes theoretical type between the unemployment rate and the percentage increase in money wages or the percentage increase in prices.” He then provided Proxmire with a copy of his 1960 paper for the committee’s consideration.

As his testimony resumed, Samuelson asserted quite plainly that the “general policy implications of the above analysis are quite clear.” Though limited by time to expand upon them, he urged the committee to adopt “expansionary fiscal and monetary measures and the more direct programs for retaining manpower” in reference to a suite of government jobs training initiatives – two approaches he described as “supplementary, in my view, rather than competitive. This is a case where the whole will add up to much more than the sum of the separate parts.”

Keeping in mind the closing paragraph from Samuelson-Solow (1960) as quoted above, it might be reasonably inferred that by late 1961 he was pressing the more encompassing suite of programs hinted at therein. A written memo accompanying Samuelson’s testimony further expands upon his prescriptive points as well, making note that, though warranting further study, “the preponderance of the existing evidence and analysis suggests to me that something like two-thirds or more of the described increase in unemployment has been due to the inadequacy of overall dollar demand.” This observation though was further “complicated by the fact that even if there were zero “structural unemployment” there might be a tendency for wages and prices to rise for cost push reasons even before the percentage of unemployment had been reduced down to a tolerable and desirable low percentage.” He then goes on to recommend a suite of federal jobs training programs, federally managed employment information exchanges, and aggressive anti-trust enforcement. In other words, he was informing them of a theorized policy implication of Phillips Curve and imparting them with policies that he thought would advantageously manipulate the parameters of that curve – just as he suggested in the final sentence of the 1960 article.

If the 1961 hearing is suggestive, Samuelson’s other actions in this period should remove any doubt of his prescriptive intentions in attempting to enlist the Phillips Curve to macroeconomic policymaking. Brian Domitrovic, who has written extensively about the Phillips Curve fiasco of the 1960s and 70s, alerts me to several such instances from Samuelson’s own capacity as an economic adviser to the Kennedy and Johnson administrations. The first comes from an early 1961 memo that Samuelson wrote to the Kennedy transition team:

“A careful survey of the behavior of prices and costs shows that our recent stability in the wholesale price index has come in a period of admittedly high unemployment and slackness in our economy. For this reason it is premature to believe that the restoration of high employment will no longer involve problems concerning the stability of prices. Postwar experience, here and abroad, suggests that a mixed economy like ours may tend to generate an upward creep of prices before it arrives at high employment. Such a price creep, which has to be distinguished from the ancient inflations brought about by the upward pull on prices and wages that comes from excessive dollars of demand spending, has been given many names: “cost-push” inflation, “sellers” (rather than demanders) inflation, “market power” inflation, – these are all variants of the same stubborn phenomenon.”

While Samuelson contextualized this comment amidst a broader ongoing dialogue in the economics discipline about the nature of inflation, it is evident he was mapping out an underlying Phillips Curve-based mechanism. He goes on to acknowledge a divergence of expert opinion on the problem of inflation but then proceeds to a lengthy prescriptive warning:

“[I]t should be manifest that the goal of high employment and effective real growth cannot be abandoned because of the problematical fear that reattaining of prosperity in America may bring with it some difficulties; if recovery means a reopening of the cost-push problem, then we have no choice but to move closer to the day when that problem has to be successfully grappled with. Economic statesmanship does involve difficult compromises, but not capitulation to any one of the pluralistic goals of modern society.” (emphasis original)

If Samuelson did not intend to convey an exploitable unemployment-inflation trade-off in the policy sphere, he certainly chose a poor way of expressing himself. The next example comes from a 1964 memo prepared by an advisory committee to LBJ under Samuelson’s direction. By this point Samuelson appears to have been operating under a full-fledged embrace of the operationalized implications of his work on the Phillips Curve.

“An economy which is always near full employment faces a more persistent threat of inflation than a stagnant economy. The remarkable price stability which the U.S. has maintained over the past 6 years has in part been due to the high level of unemployment. One way of assuring a continuation of this price stability would be to tolerate continuing high unemployment. Like most Americans, we reject this “solution” to the problem of inflation. Yet the reconciliation of price stability with full employment is a thorny problem – one to which there are no tried and tested solutions.”

The memo then proceeds to suggest a variety of policy solutions that might mitigate inflation, including “vigorous enforcement of antitrust laws,” increased spending on federal jobs programs, freer trade, and federal intervention against market “barriers” to price competition such as monopoly. It is important to realize that Samuelson actually eschews inflation as a tolerable policy onto itself, though two things may be noted here:

(1) His further prescriptive observations reflect the extension of his own search for other manipulable characteristics that could favorably alter the parameters of the Phillips Curve, as suggested in the closing lines of the 1960 article. Note that this directly chafes with the revisionist account, which questions the presence of an exploitable Phillips Curve. Samuelson quite plainly thinks “yes, it can be exploited” but far from recognizing a problem of “instability” of an order that limits the curve, he has at this point identified its anticipated shiftiness as an additional exploitable characteristic.

(2) A key point of Friedman’s critique is important here as well, as he called into question not just the naive trade-off that Samuelson was assuming from the Phillips Curve but also the constraining implications of his expectations critique upon the curve: that attempts to exploit it in the manner being discussed in policy circles would invariably initiate an inflationary course with stagflationary risk, the various under-developed and concurrent attempts Samuelson was undertaking to further exploit or control a shift of the curve itself notwithstanding.

When turning to his continued forays into policy, the staying power of a prescriptive and exploitable Phillips Curve in Samuelson’s work becomes similarly difficult to escape. He famously incorporated it into his widely used economics textbook in the mid 1960s, and regularly extolled its prescriptive uses in a column for Newsweek magazine. By the time that his original 1959 paper with Solow was excerpted and republished as a “menu of policy choices” in 1965, there was absolutely no doubt in the public arena that he intended such implications to be drawn from the more notorious prescriptive passages I have excerpted at the outset of this post.

Similarly revealing are Samuelson’s comments in a 1967 debate sponsored by the American Enterprise Institute, the text of which may be found here. It shows a Samuelson who was quite enamored with the policy implications of the Phillips Curve. As he informed the audience,

“[O]ne must not exaggerate the exactitude of the Phillips curve but nevertheless it is one of the most important concepts of our times. Any criticism of the guideposts which does not explicitly take into account the Phillips curve concept I have to treat as having missed the fundamental point of all economic policy discussions.”

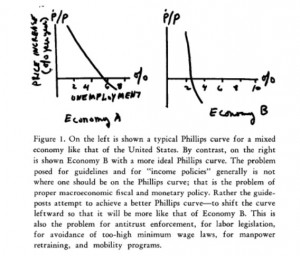

So where then did this concept stand with Samuelson in 1967? As his remarks at AEI reveal, he was aggressively toying around with the final point of his 1960 article with Solow: how to externally manipulate the location of the Phillips Curve through other policies for the purpose of making it further exploitable as a relationship for movements along the curve. He proceeded to identify a “good” and a “bad” Phillips Curve based upon their respective optimality for this persisting goal of operation along the curve. As he put it at the time, “Macroeconomic policy can determine where you are on the Phillips curve. But if you have a bad short- or long-run curve, macroeconomic policy cannot give you a good Phillips curve.” This, he suggested, had to come externally through a suite of policies to induce a more “ideal” Phillips Curve. His hand-drawn example from the lecture may be seen below:

Note that in the explanatory paragraph, Samuelson further specifies the two concurrent policy questions underlying his attempted use of the Phillips Curve. First is the problem of whether the curve itself is at an “ideal” location or not, implying not instability in the curve but an ability to manipulate it externally. And the second issue is the location of an economy along the curve itself, which “is the problem of proper macroeconomic fiscal and monetary policy” – again fully endorsing the original notion of an unemployment/price level trade-off, which would indeed still be a “stable” operating and exploitable target within the idealized parameters of an already-attained “good” Phillips Curve for the country. As Samuelson had asserted all along and was now arguing with increasing sophistication, the policy question about the Phillips Curve was really a two-component proposition, and both components – he plainly believed – were manipulable.

Except that it simply wasn’t so, and a growing number of academic critics posited reasons why it wasn’t so: expectations traps that led to a vertical long run curve, behavior adjustments taken in anticipation of policy premised on the curve, difficulties in identifying the operating point of an economy along the curve, and even the overall empirical weakness of the purported relationship. Far from salvaging the Phillips Curve from its deficiencies, the ensuing literature thoroughly undermined its Samuelsonian iteration and incapacitated it as a functional policy-making mechanism.

Samuelson himself resisted the incoming repudiation of his attempts to operationalize the concept. As late as 1971 and well after Friedman’s formal critique appeared in the economic literature (1968), Samuelson was still pushing a hardline prescriptive orthodoxy around the Phillips Curve. In a letter to the New York Times (12/29/1971) reflecting on leadership changes in Nixon’s Council of Economic Advisers, he noted the following:

“But how can any economist throw a stone at him for not having predicted the unpredictable – the fact that the cost-push (or Phillips curve) pathology of hte American mixed economy has turned out to be so much worse than past patterns of experience had suggested? By this I mean: All the regression equations to predict how much deceleration of price and wage inflation the Nixon-engineered stagnation would induce, proved to be systematically overoptimistic. For a little unemployment, we got only a derisory reduction in the rate of inflation.”

This is not the language of an inquisitive scientist as he encounters the first cracks in a prior supposition; it is a rigid clinging to a prior orthodoxy around an exploitable Phillips Curve whose performance was increasingly at odds with empirical evidence. And with it came a bitter lashing out at those he had influenced, not for want of their own attempts to continue a failed exploitation of the curve but for their less rigid adherence to the prescriptive course he himself had laid out.

In turning to these policy examples, it is not difficult to observe what is missed in the revisionist Phillips Curve narrative of Forder and others. The “myth” of an exploitable Phillips Curve is no myth at all where Samuelson is concerned, and indeed he likely viewed it as another manipulable component of his growing macro system that could be subjected to policy ends both within its framework – i.e. a movement along the curve – and externally through a consciously induced shift of that curve.

Where ambiguities in the text of the 1960 article and a few sparing selections from the subsequent academic discussion seem to provide an air of plausible deniability around his connection to the notion of an exploitable Phillips Curve, it is actually Samuelson’s concurrent actions in the public policy sphere that belie the “myth” revision. His advice to policymakers in Congress and the White House shows that he viewed the curve as an exploitable extension of prescriptive macroeconomic policymaking. And where such policy implications are only hypothesized in the 1960 article, they are connected in tangible and specific instances to the legislators and presidents he was urging them upon throughout the 1960s. The revisionist account reminds us of nuance in academic writing and even inadvertently teases out a more complicated element of prescriptive manipulation in Samuelson’s consideration of a “shifting” curve. But it is at best an exercise in selective evidence assemblage to exonerate Samuelson from an episode that his own policy work directly reveals to the contrary.